Progressive Goes Backward: We Can learn from the Auto Insurance Company Fail

When I first read the story about Progressive Auto Insurance and the death of one of their clients, a woman named Kaitlynn Eileen Fisher, I was pretty perturbed. I wasn’t alone. The Internet lit up. The tragic accident and ensuing court debacle was being retweeted thousands of times per minute. From a mere human perspective, […]

When I first read the story about Progressive Auto Insurance and the death of one of their clients, a woman named Kaitlynn Eileen Fisher, I was pretty perturbed. I wasn’t alone. The Internet lit up. The tragic accident and ensuing court debacle was being retweeted thousands of times per minute. From a mere human perspective, death takes a toll, and as a father I can’t fathom what the parents of the young John Hopkins graduate have endured. But from the point-of-view of a business, and a company that thrives on great customer service, it’s painful to see such a large company stumble and fail. Repeatedly.

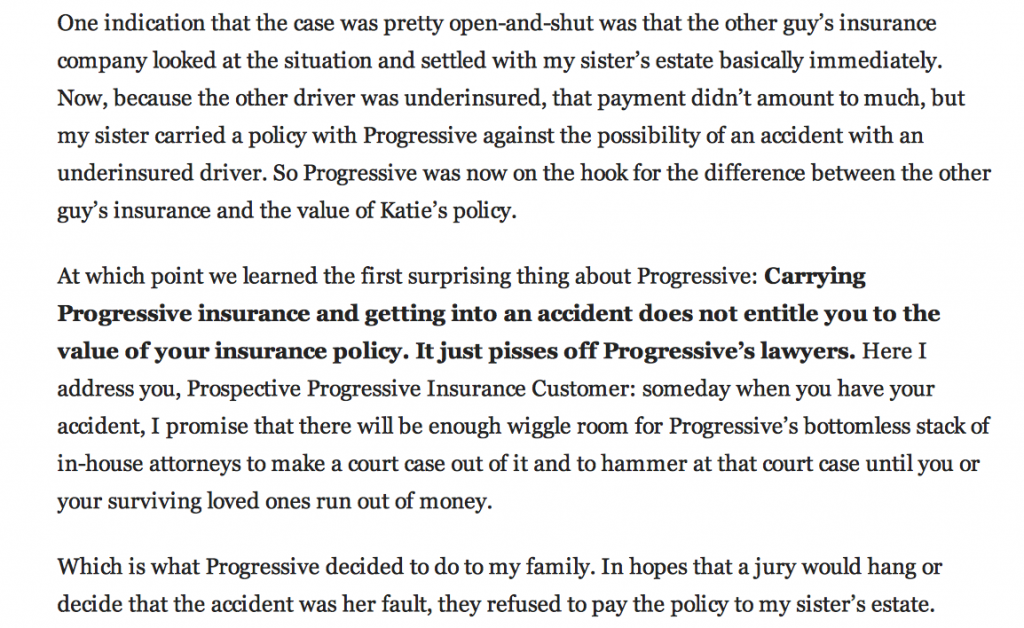

It all began with a guy running a red light. His SUV plowed into Fisher’s Honda. A split second shredded everything those families knew, and in the scrambling for answers, the least they could hope for was the compensation they’d secured to help cover those suddenly trivial accumulations, like Kaitlynn’s student loans. It didn’t happen like that, and according to the now viral blog post written by her brother, Matt Fisher, Progressive Auto Insurance failed to follow through with what was expected from her policy.

Here, Matt explains what went from the typical death claim, to that of an arduous legal battle.

His accusations go so far as to say Progressive’s lawyers defended the man who ran the red light. Progressive has now denied that (and Fisher countered), but–and here’s where they defy the odds and continue to screw up–they’re doing it two days after the blog came out. Two days in insurance lawyer land is an eternity on the web. Progressive finally put humans out front to explain themselves. That’s only after the auto-responses on Twitter made them look even more like assclowns.

Here’s the frigid Twitter outreach conducted by an Autobot:

So here we are with young life gone, a family shattered and an insurance company not prepared to deal with being caught as Satan’s puppet. There are so many things wrong here that I’ll start post-mortem, actually even post trial, and suggest that a company that boasts on their website that from 1996 to 2005 they “grew an average of 17 percent per year, from $3.4 billion to $14 billion” should be able to afford someone to sit on their Twitter and make an actual human response to a tragically human situation.

Even more importantly though, is that social media has pulled back the veil on this creepy marriage between big money and poor service. There’s a helplessness that people are supposed to feel when they are confronted by a team of lawyers from a behemoth oligopoly. But now…maybe not so much. We know that the chance of something going viral is insanely small, yet the odds that people truly care, people not even being paid a premium, are big. And now Progressive needs to know that. All companies should.

To do that, give your insurance company a call and ask about their policies. It’s time to put their customer service to the test. If we can be up answering tweets about ten-dollar domains, then the least they can do is comfort those paying thousands for something as precious as piece of mind.